|

|

Drew’s Note: As I try to do every Friday, I’m pleased to bring you a guest post from yet another interesting thought leader who shares his insights via the blogosphere. So without further ado…Dr. Mark Klein. Enjoy!

A defector is a customer who is no longer buying from you. ‘No longer’ is a relative term; most companies say that a customer is no longer a customer when some well (or in some cases, not so well) defined period of time has elapsed since their last purchase.

Since customers are the most valuable asset of a business, it is extremely important to build early warning systems to spot potential defectors before they walk away — it is much easier to retain a potential defector than it is to reactivate them once they’ve left.

This process is called At-Risk Assessment, and mathematical marketing makes it possible.

An At-Risk analysis should deliver two related numbers for each customer: the probability of defection and the At-Risk percentile rank. The latter number comes from ranking all the customers according to their probability of defection. Customers with a higher risk ranking are more likely to defect than customers with a lower risk ranking. Knowing these numbers, a company can build a strong program to prevent defection.

How to calculate an at-risk score

What doesn’t work too well is just looking at declines in a customer’s purchasing patterns. These may be leading indicators of defection, but by the time they are recognized, it may be too late for an offer with the needed incentives to retain a valued customer. Other methods are needed to spot the potential defector earlier, which is why assuming that the customers at risk are those on the lower end of the loyalty score spectrum is a flawed approach.

The best approach is:

- Identify a set of variables or customer characteristics that may be leading indicators of defection.

- Analyze these variables using a technique known as Logistic Regression, which lets us determine which of these variables are actually significant indicators of defection.

- Use what we’ve learned to actually assign a probability of defection to each active customer.

Logistic Regression tells us how much of the probability is explained by each of the predictor variables, and we can rank them accordingly. This makes the probability more actionable since we have some guidance as to what we need to offer to each customer.

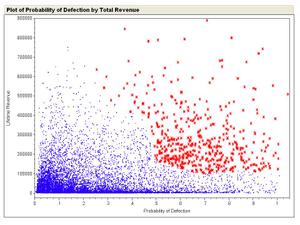

The chart below shows the distribution of At-Risk scores for a real company, along with the revenue from each customer. Each dot is an identifiable customer. Customers to the right have a higher risk of defection than those to the left. The red dots represent high value customers with a higher risk of defection. (Click on chart for full-sized view)

Done properly, a Logistic Regression analysis can tell us:

- How accurately the model is assigning customers based on the relevant factors

- Which customers exhibit traits of an active customer, yet have become inactive; they were predicted to respond to our campaigns but did not, and may be worth another touch

- Which customers are active, but exhibit all the traits of a defecting customer, the truly At-Risk customer

Stay tuned for part two of this guest post…how to use At Risk scores.

Dr. Mark Klein is is CEO of Loyalty Builders LLC, the developers of Longbow, a web-based direct marketing system that predicts the future buying behavior of existing customers. He blogs frequently on Mathematical Marketing and recently published his first novel.

Every Friday is "grab the mic" day. Want to grab the mic and be a guest blogger on Drew’s Marketing Minute? Shoot me an e-mail.